Utility and Tax Incentives

Federal, state, and local governments understand the importance of sustainable energy and the high costs associated with traditional power sources. Utility companies can’t afford to maintain their infrastructure costs as homes use more and more power. That’s why, in most cases, utility and tax incentives can save customers well over 50% on the cost of energy.*

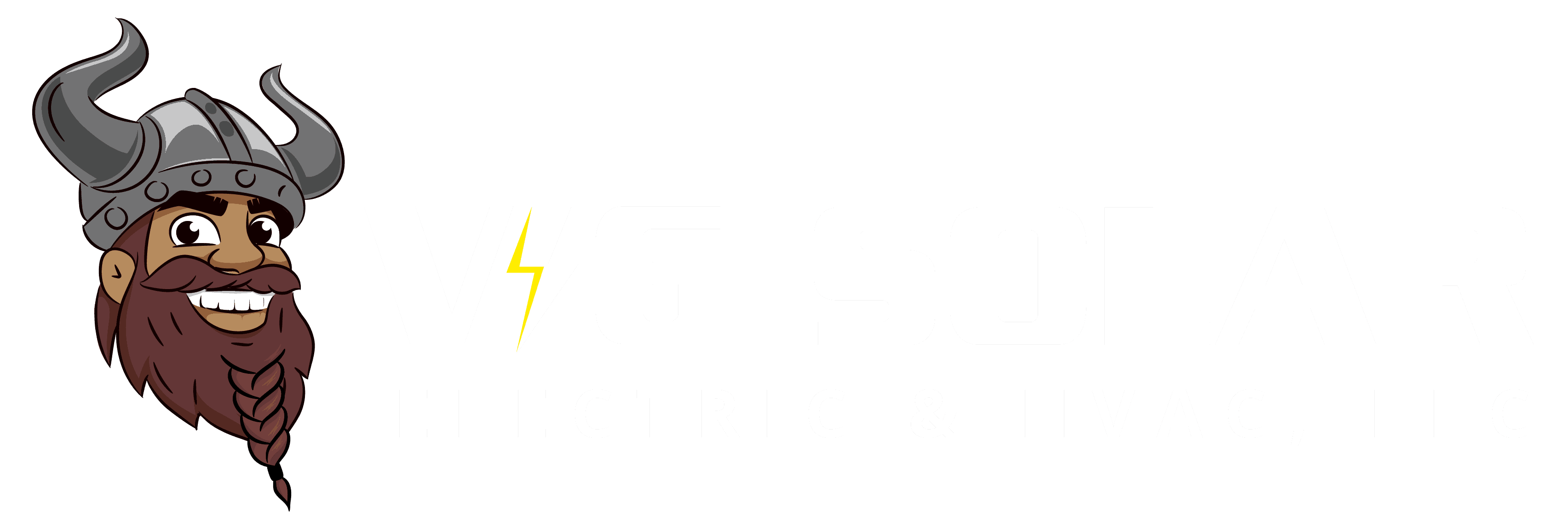

Federal Investment Tax Credit – 30%

The solar investment tax credit (ITC) is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government. The federal ITC is based on 30% of the homeowner’s cost to install solar from 2022-2032. On leased systems, SunPower® collects this incentive and passes the savings on to the homeowner. Don’t wait, prices for solar equipment are on the rise! Hurry and take advantage of this while it lasts.

Nevada State Incentives

Nevada offers several financial advantages when it comes to solar energy, such as a federal tax credit and a robust net metering policy that enables residents to earn credits on their electricity bills by selling excess solar energy.

Nevada residents who choose to install a solar energy system on their homes can take advantage of the net metering program. Net metering is a billing arrangement that allows you to receive credit on your electricity bill for any surplus solar energy you generate and send back to the grid.

Nevada residents who choose to install a solar energy system on their homes can take advantage of the net metering program. Net metering is a billing arrangement that allows you to receive credit on your electricity bill for any surplus solar energy you generate and send back to the grid.

By participating in net metering, you not only become a self-sufficient provider of clean energy but also contribute to the wider adoption of solar power in your local community. Moreover, you receive compensation for the excess energy you contribute.

The specifics of net metering can vary depending on the state and utility company. In Nevada, where approximately 93% of residents are served by NV Energy, an investor-owned electric utility company, there is a requirement, mandated by legislation, for nearly one-to-one net metering. This means that the credit provided by NV Energy for surplus energy is nearly equivalent to the cost they would typically charge for electricity.

If, at the end of your billing cycle, you have remaining kilowatt-hour credits from your solar system, they will be carried over to the following month at approximately 75% of the retail rate.

Nevada stands out as one of the few states where investing in battery storage alongside solar panels can be financially advantageous. NV Energy, the utility company in Nevada, provides incentives for energy storage systems when combined with solar installations:

Nevada stands out as one of the few states where investing in battery storage alongside solar panels can be financially advantageous. NV Energy, the utility company in Nevada, provides incentives for energy storage systems when combined with solar installations:

- Customers with time-of-use (TOU) rates can receive up to $3,000.

- Customers with standard rates are eligible for incentives of up to $1,500.

Time-of-use rates refer to electricity pricing that varies depending on the time of day when electricity is consumed. During periods of high demand, such as hot sunny days or late afternoons and early evenings, utilities charge higher rates. Conversely, electricity is priced lower during times of low demand, such as late at night when expensive power plants are not required to meet customer needs. Hurry these incentives won’t last!

Installing solar panels on your home increases its value up to 20 times your annual energy bill savings. We don’t think you should be penalized for your sustainable decision and many state legislators agree! Currently, new solar installations will be subject to no additional property taxes based on their assessed value.

Increase Home Value

Having a residential solar energy system on your property is known as a capital improvement which adds to your property’s value. This means that you can potentially sell your home faster and for more than homes without solar. Your investment in efficient, clean solar power also adds to the tax basis of your home. If you sell the home, this tax basis investment can be deducted from the sale’s price, reducing the amount of the price that is counted as profit. This reduces the taxes taken from the sale and may be able to help you avoid capital gains taxes on appreciation.

*Ask your representative about which incentive you’re eligible to receive. Please consult a tax advisor on your ability to claim these nonrefundable tax credits.